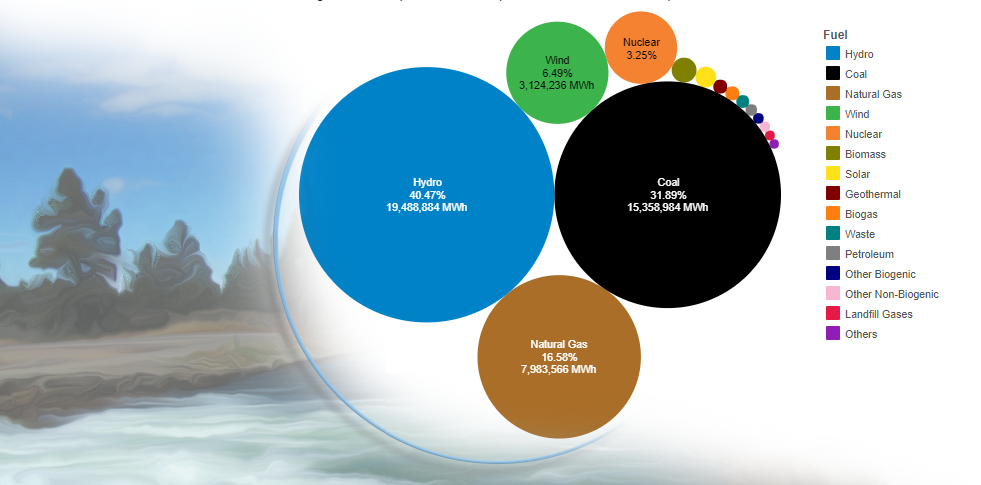

The business energy tax credit program otherwise known as betc was created to incentivize the pursuit of energy efficiency and renewable energy among oregon businesses.

Oregon energy credits 2018.

X x x 859.

Oregon ida initiative fund donation.

Making energy efficient upgrades to your home is a great way to save money and energy while improving comfort.

The residential energy credits are.

2018 energy incentives program eip tax credits oregon transparency skip to main content skip to footer links.

Rachel wray oregon department of energy.

X x x 857 renewable energy development fund contributions.

After two decades of operation.

They ll be in effect until 2021 with a gradual step down in credit value each year.

X x x 855 oregon production investment fund contributions.

Right now many of us are spending more time at home and are likely seeing energy bills go up as a result.

X x x 856 pollution control facilities carryforward.

The oregon department of energy or odoe was charged with its m anagement.

We do monitor developments at the state legislature to understand potential impacts on programs and services available for utility customers including the availability of energy efficiency and solar tax credits which often factor into customers.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Claim the credits by filing form 5695 with your tax return.

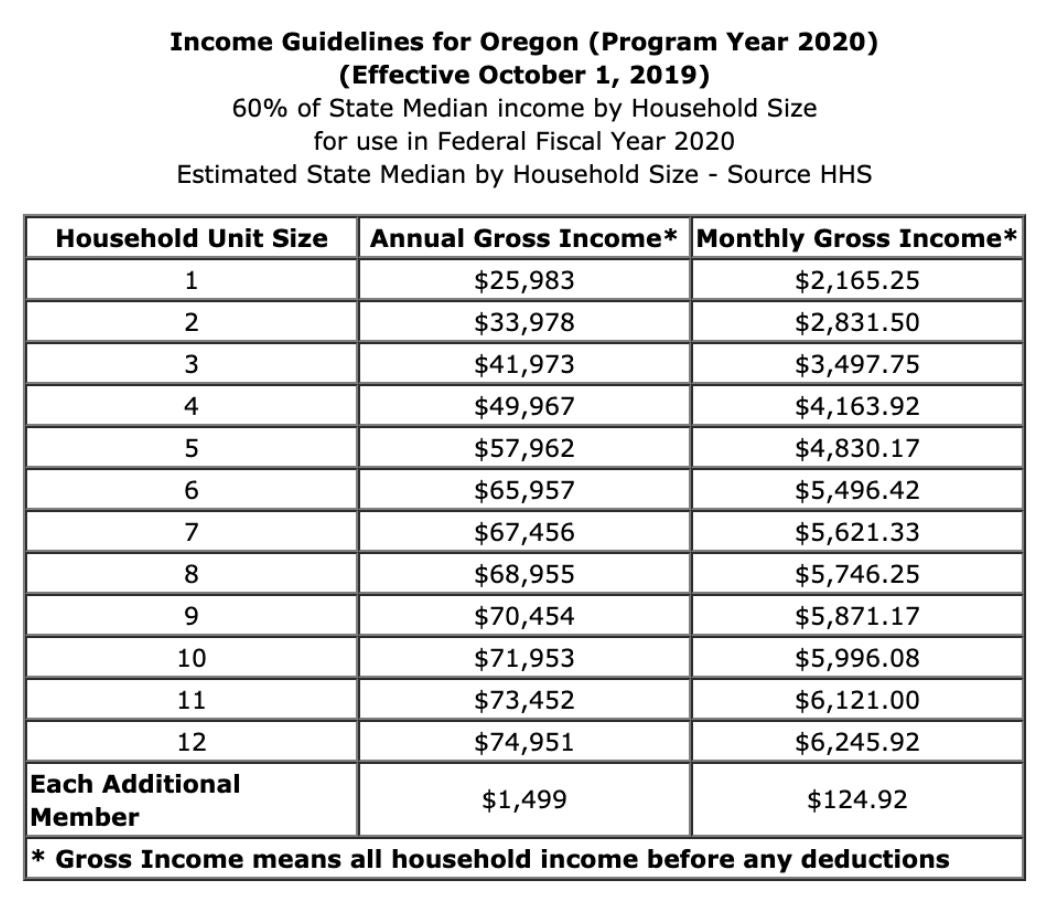

Oregon residential energy tax credit homeowners who installed solar panels prior to december 31 2017 were eligible for a credit on your oregon state taxes to help recover expenses.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The credit was valued at 1 70 per watt w of installed capacity up to 6 000.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

Energy trust of oregon does not take positions on legislation or engage in political issues.

From ductless heat pumps to rooftop solar to electric vehicle chargers your energy efficient improvements have made a big difference saving money saving energy and.

The oregon department of energy s residential energy tax credit program ended in 2017.

X x x 852 oregon low income community jobs initiative new markets.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Thank you to the nearly 600 000 oregonians who participated in the program since 1977.